A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. 20 of the QPE incurred.

Corporate Income Tax In Malaysia Acclime Malaysia

Rent must be paid in full.

. Tax rebate for self. The rental income commencement date starts on the first day the property is rented out whereas. There would be a credit for up to 4000 in vacation expenses under the travel tax credit.

19 rows Additional deduction of MYR 1000 for YA 2021 increased maximum. To legislate the above-mentioned proposal the Income Tax Deduction for Expenses in relation to Listing on Access Certainty Efficiency ACE Market or Leading. 1 On 5 July 2019 the Malaysian Inland Revenue Board the IRB released guidelines.

Under the Rules QPE refers to a capital expenditure incurred under paragraph 2 of. Tax rebate for Self. In order to be eligible for PWP the expatriates salary must be paid by the overseas company.

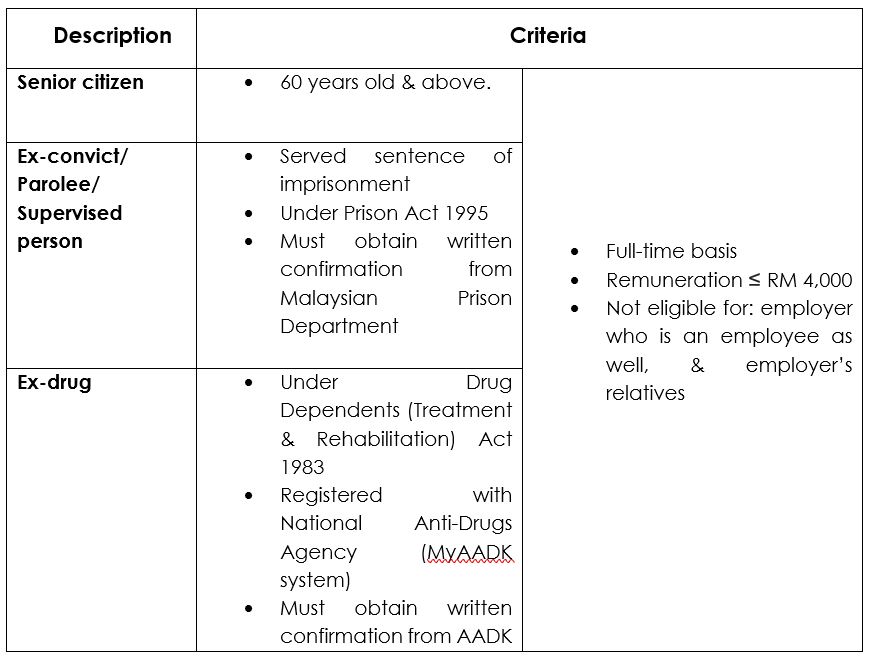

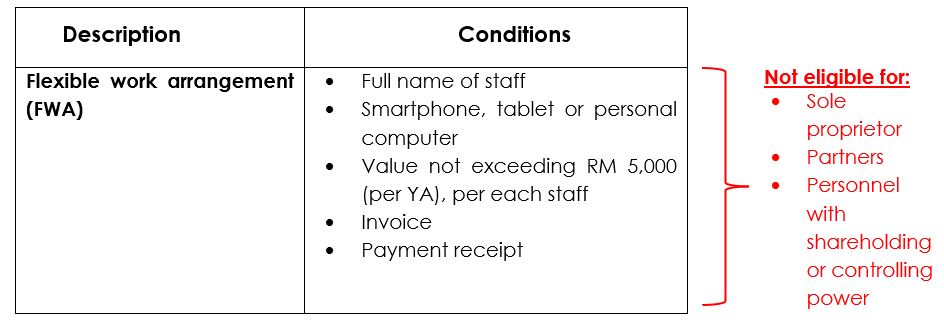

Getting A Tax DeductionTax Incentive For Your Company. Are Vacations Tax Deductible In 2020. Yes there is a tax deduction for employers in Malaysia subjected to the terms and conditions set by the LHDN.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2020. 40 of the QPE incurred. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

If your chargeable income after. Advertising expenses Salaries and bonuses. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and.

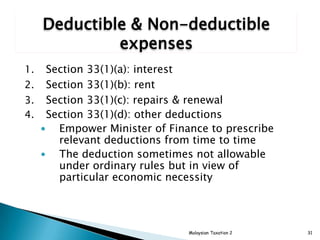

Interest expense is allowed as a deduction if the expense was incurred on any money borrowed and employed in the production. Section 33 1 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and. Tax rebate for self.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. Resident companies are taxed at the rate of 24. The Income Tax Deduction for Expenses in Relation to Listing on Access Certainty Efficiency ACE Market or Leading Entrepreneur Accelerator Platform LEAP Market.

Under section 331 of the Income Tax Act 1967 ITA all outgoings and expenses wholly and exclusively incurred during a specified period by the business in the production of gross income from a source is deductible. The tax year or year of assessment YA for individual tax runs from 1. LEGAL and professional expenses are deductible under the Income Tax Act 1967 ITA when they are incurred in the maintenance of trade rights or trade facilities existing or alleged to exist.

From a plain reading of section 331 of the ITA the. Resident company with a paid-up capital of RM 25. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income.

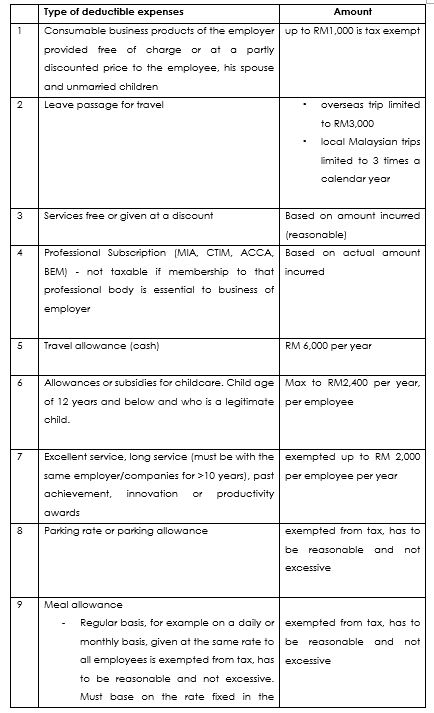

Expenses for the employee medical. The following expenses can be deducted from rental income in Malaysia. This tax applies to assessments.

However there are specific deductions allowed such as incorporation expenses and recruitment expenses conditions apply. 14 Income remitted from outside Malaysia. There was an opportunity for the travel industry.

Some of the most prominent deductible corporate expenses include. On 28 June 2019 Malaysia issued rules the Rules on the interest deductibility limitation. November 20 2021.

Other corporate tax rates include the following. Purchase of breastfeeding equipment for own use for a child aged 2 years and below Deduction allowed once in every 2 years of assessment 1000 Restricted 13. The standard corporate income tax rate in Malaysia is 24.

These tax incentives appear in various forms such as EXEMPTION ON INCOME EXTRA ALLOWANCES ON CAPITAL EXPENDITURE INCURRED DOUBLE DEDUCTION OF EXPENSES.

Updated Guide On Donations And Gifts Tax Deductions

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Chapter 5 Corporate Tax Stds 2

Tax Treatment For Entertainment Expenses

List Of Tax Deduction For Businesses Cheng Co Group

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group

Focus Malaysia Taxation In Malaysia Expense Deduction Dilemma Thannees

Types Of Taxes In Malaysia For Companies

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Ks Chia Tax Accounting Blog How To Maximise Your Entertainment Expenses Deduction

Tax Treatment On Entertainment Expenses Asq

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

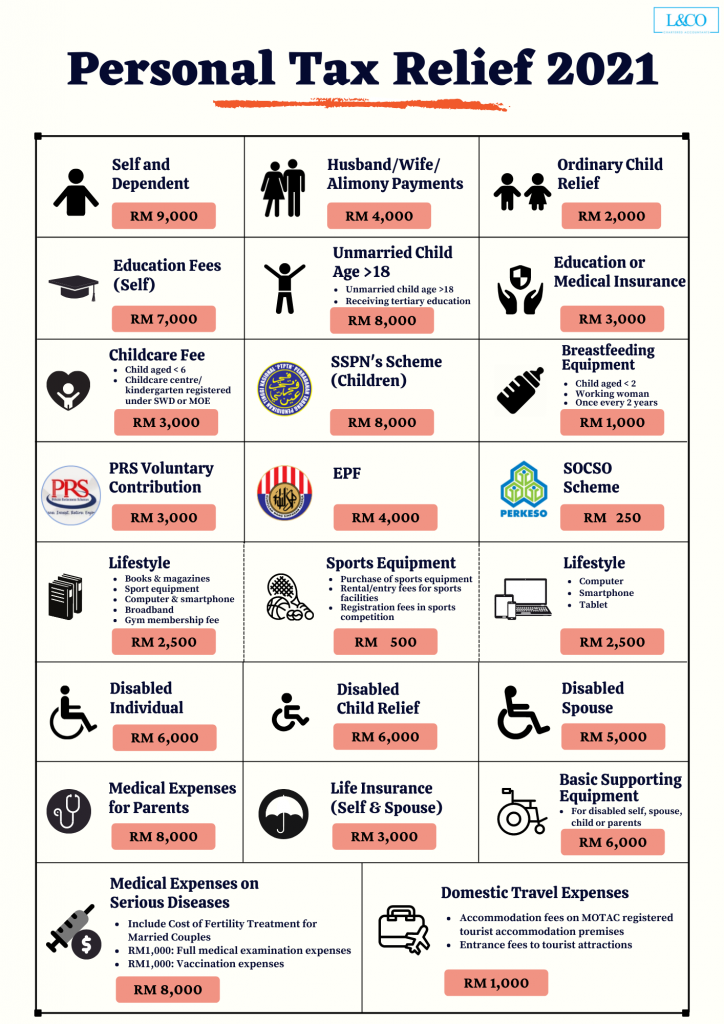

Personal Tax Relief 2021 L Co Accountants